we invest in the future ,Now.

We are looking for rebel tech Founders like you

ETM is a rebellious Venture Capital Firm that seeks founders wanting to change the rules of the game in the technology world.

We invest in pre-seed and seed rounds, supporting bold and visionary entrepreneurs aiming to revolutionize the tech industry.

Subscribe To Our Newsletter ,it’s Free.

About Us

We are different . We're not just a venture capital firm. We're founders before we're investors. Understanding the challenges of turning an idea into reality is part of our DNA. We're here to push ideas to the max, assembling teams that don't settle for podium finishes but aim for the top spot, always.

Companies we invest in:

The companies we invest in are characterized by cutting-edge technologies and innovative business models. We select startups with strong growth potential, demonstrated revenue-generating capabilities, and a clear vision to revolutionize their industry. We actively support these businesses by providing financial capital, strategic guidance, and access to our extensive network of resources to foster long-term success.

Artificial Intelligence |Machine Learning

Artificial Intelligence |Machine Learning

Blockchain Infrastructure

Blockchain Infrastructure

Internet Of Things (IoT)

Software As A Service (SaaS)

Software As A Service (SaaS)

Financial Services | Payments

Financial Services | Payments

we are legion.

With ETM Capital, our commitment goes beyond simple seed funding. We’re here for you at every stage of your entrepreneurial journey. We provide comprehensive assistance throughout your project’s development, targeted marketing strategies, a solid network, and full support for the subsequent steps of the process. From the moment you join our legion, you can rely on us to guide and support you through every challenge you encounter on the path to success.

LP

Become an Lp

We’re a top-tier fund supporting tech startups, exclusively open to accredited investors. Accredited LPs join a select group of individuals making informed financial decisions. Pass our rigorous application process to gain access to world-leading tech startups. With a decade of industry experience, we ensure only the best investment opportunities reach our LPs.

Apply now to be at the forefront of the global tech scene.

From Investment Rounds to Crucial Development Stages: We're with You Every Step of the Way on the Path to Success.

Our Board.

You're one step away from takeoff.

It all starts with that idea in the mind, things that may seem trivial to others are not for us. Whether you’re at the idea stage or have developed your MVP, don’t hesitate to send us your pitch. Next IPO could be yours.

-

Send us your presentation pitch.

Send us your complete presentation pitch. It’s the first step to getting to know you. It doesn’t matter if it’s not perfect or if there’s no complete business plan. We believe that a demo is worth more than any number, especially in the initial phase. Don’t hesitate to send us your project. Before being investors, we were founders too. We know what it means to be in your shoes.”

-

Expect to hear from us soon

Waiting is part of the game. We receive numerous projects every month that we need to evaluate. When you hear from us, it’s because we genuinely want to get to know you.

-

We are ready to launch together

We’re ready to go! Forget those long calls and back-and-forth contacts. As soon as we’re interested in your project and idea, we’re immediately ready to start building a future together, filled with success.

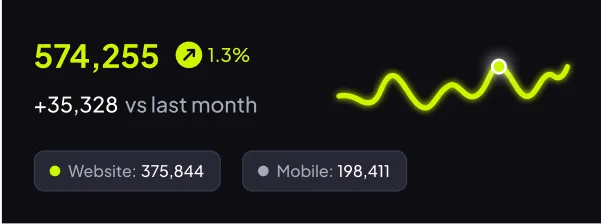

Key Metrics in the Tech Startup Landscape Over the Last Decade

Sizing Up Success: Insights into Tech Startup Growth, Funding, and Progression.

Approximately 50,000 new tech startups have emerged worldwide in the last 10 years.

Over the past 10 years, around 500 tech startups have gone public through an Initial Public Offering (IPO).

Approximately 25% of startups that received seed funding have successfully progressed to round A or B.

Total investments in the tech sector over the last 10 years have surpassed $500 billion.

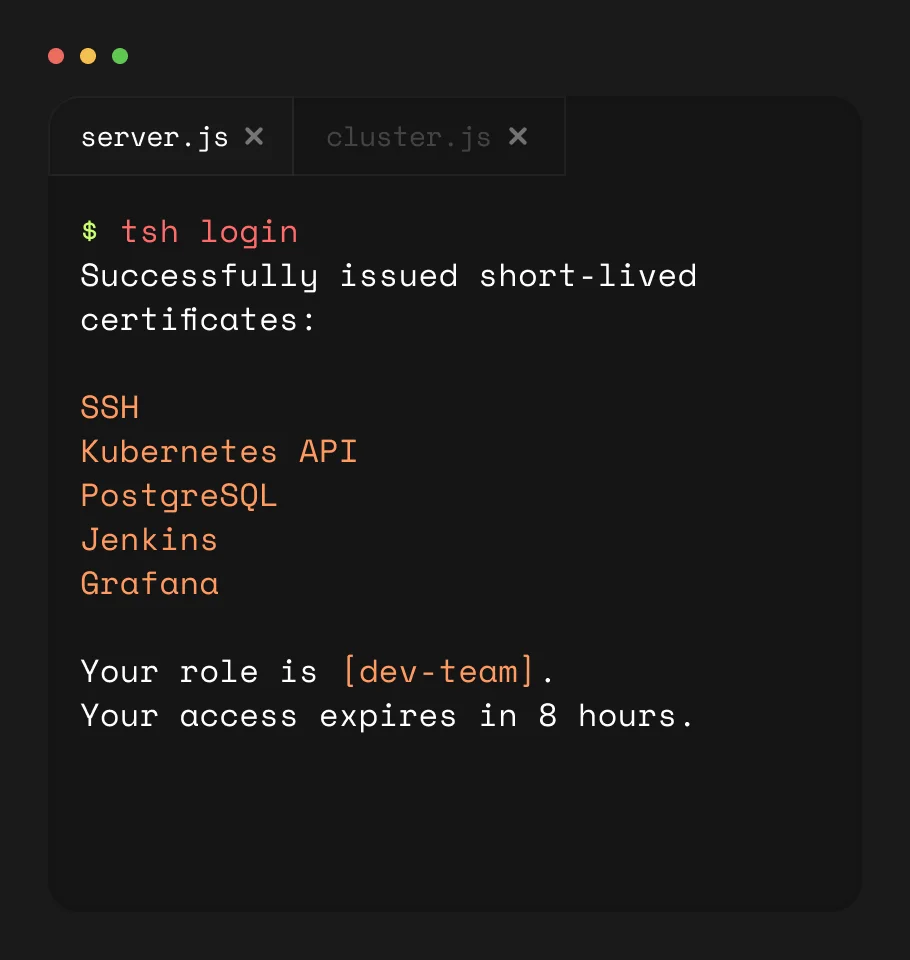

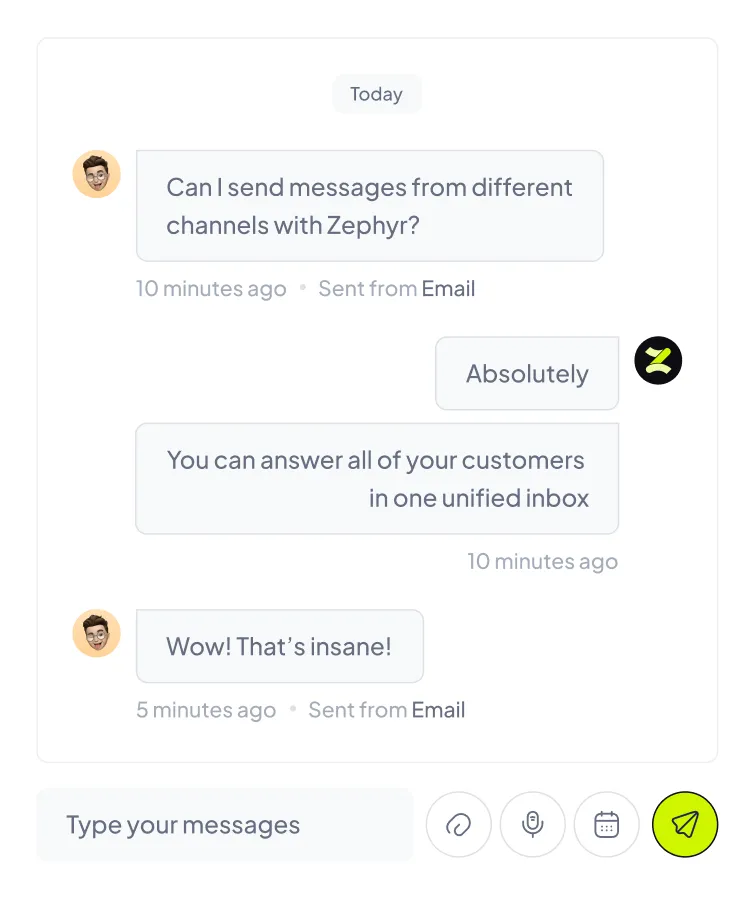

- We're always connected.

Our Team is Always Engaged with Your Startup

We understand the challenges of building a model, sourcing the right resources, maintaining stable costs, and marketing, which is why we’ve built a model capable of staying in continuous contact with our experts.

- Always informed

- Time efficient

- Data-driven

Richard Grayson

Hi, I just finished analyzing the financial data of startup XYZ. It seems they’ve had a significant increase in revenue in the last quarter

Travis Barker

“Interesting! I believe this is the result of their recent marketing initiatives and customer base growth.”

Carlos Santana

I agree. We should also carefully examine their cost structure to ensure it is sustainable in the long term

Thread Summary

The analyst team is discussing the financial data of startup XYZ, noting a significant increase in revenue due to marketing initiatives and customer base growth. They are also attracting significant investors in the industry. It is suggested to further expand market presence and carefully examine long-term cost sustainability. A call with the startup management team has been scheduled to discuss the findings and suggestions.

- Subscribe

Subscribe to Our Exclusive Newsletter.

We share key insights on Product Market Fit, growth strategies, metrics, fundraising, tools, & personal development for your startup journey

Etm Capital Manifesto

If you’re going to try, go all the way. Otherwise, don’t even start. If you're going to try, go all the way. This could mean losing girlfriends, wives, relatives, jobs and maybe even your mind. It could mean not eating for three or four days. It could mean freezing on a park bench. It could mean jail. It could mean derision, mockery, isolation. Isolation is the gift. All the others are a test of your endurance, of how much you really want to do it. And, you’ll do it, despite rejection and the worst odds. And it will be better than anything else you can imagine. If you’re going to try, go all the way. There is no other feeling like that. You will be alone with the gods, and the nights will flame with fire. DO IT. All the way You will ride life straight to perfect laughter. It’s the only good fight there is.

Charles Bukowski

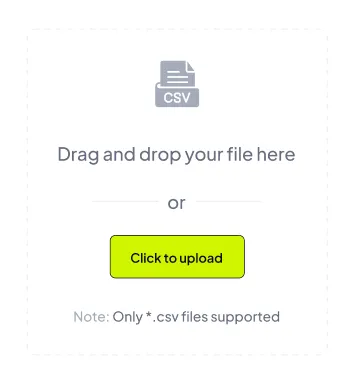

Don’t hesitate to reach out

We know very well that initial contacts can be intimidating, but you don’t need to be afraid. We’re in the early stages, and what matters most to us is that you have a demo of your product rather than a perfect business plan. Contact us, upload your pitch, and we’ll get in touch with you as soon as possible

Please fill in this form

Frequently Asked Questions

In addition to funding, we provide operational support, access to our network of mentors and industry experts, as well as networking opportunities.

We employ a rigorous evaluation process that includes analysis of the business model, founding team, target market, and growth potential.

We look for startups with a competent founding team, an innovative business model, a growing market, and a clear competitive advantage.

We offer active support through mentorship, strategic counseling, access to our network, and resources for business development.

We aim to build long-term relationships with invested startups, providing continuous support tailored to their needs at every stage of development.

Our fund has a successful track record in supporting high-potential startups, with competitive returns for our LP investors.

We select startups with a competent founding team, a scalable business model, a growing market, and a clear path to success.

We manage risk through portfolio diversification, diligent evaluation of investment opportunities, and ongoing monitoring of startup performance.

We use thorough valuation models that consider not only financial metrics but also qualitative factors such as the founding team and business vision.

We offer LP investors the opportunity to access a diversified portfolio of high-potential startups, supported by an experienced team and a solid investment process.

We are committed to selecting and supporting the best investment opportunities, adopting a growth-oriented strategy to ensure the success of startups in our portfolio, thereby generating stable and competitive long-term returns for LP investors.

Still have questions?

Experienced Team

Our fund is backed by a team of seasoned professionals with extensive experience in venture capital, startup operations, and financial management. This expertise allows us to make informed investment decisions and provide valuable support to the startups in our portfolio.

Robust Due Diligence Process

We have a rigorous due diligence process in place to evaluate potential investment opportunities thoroughly. This process ensures that we select high-potential startups with strong fundamentals, reducing the risk for our investors and maximizing returns.

Active Support

We are actively involved in the growth and success of the startups in our portfolio. Beyond providing capital, we offer strategic guidance, mentorship, and access to our network of industry experts to help our portfolio companies scale and thrive.